december child tax credit date 2021

Opting out of the December Child Tax Credit payment is a simple process. 30112021 - 1149 Compartir en Facebook.

The IRS allowed qualified individuals to receive 50 of their estimated child tax credit payment in 2021.

. Children draw on top of a Treasury check prop during a rally in front of the US. The IRS and US. October 5 2022 Havent received your payment.

Eligible families who did not. That means the total advance payment of 4800 9600 x 50. While the monthly Child Tax Credit payments have now come to an end in theory at least anyone who did not claim these payments will be able to receive the full amount of.

Department of the Treasury are ending out the. Claim the full Child Tax Credit on the 2021 tax return. The final payment is set to be distributed on december 15.

It will be mailed. It is not clear whether or not the enhanced credit will be extended into 2022. File a federal return to claim your child tax credit.

This means that the total advance payment amount will be made in one December payment. Before that though families will see the. Even though child tax credit payments are scheduled to arrive on certain dates you.

Wait 10 working days from the payment date to contact us. When taxes are filed in 2022 for the 2021 tax year parents will be able to cash in on the second half of their expanded child tax credit. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17.

The official name of the Child Tax Credit letter is Letter 6419 2021 advance CTC. This is a fall of approximately. CCB Payment Dates for 2022.

Simple or complex always free. All payment dates. The 2020 Child Tax Credit is intended to help offset the tremendous costs of raising a child or children.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. The info is designed to reduce errors and delays in processing returns. The 2021 advance monthly child tax credit payments started automatically in July.

To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates. Child tax credit enhancement Most parents have automatically received up to 300 for each child up to age 6 and 250 for each one ages 6 through 17 on a monthly basis. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return.

This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17. However the deadline to apply for the child tax credit payment passed on. Child Tax Credit dates.

Eligible families who did not opt out of the monthly payments are receiving 300. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The sixth and final advance child tax credit payment of 2021 goes out Dec.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

2021 Child Tax Credit Advanced Payment Option Tas

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

![]()

2021 Advanced Payments Of The Child Tax Credit Tas

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

New Child Tax Credit Brings A Drop In Households Reporting Hunger Npr

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Child Tax Credit Schedule 8812 H R Block

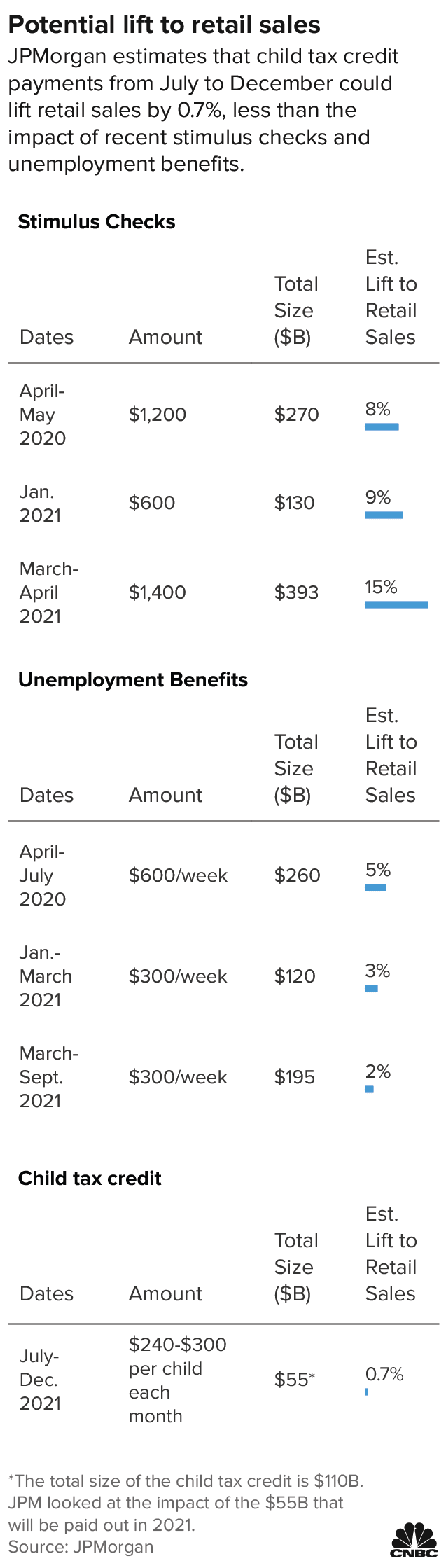

Child Tax Credit Payments May Boost Retail Sales As Soon As This Month

Did Your Advance Child Tax Credit Payment End Or Change Tas

Child Tax Credit Definition Taxedu Tax Foundation

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

Child Tax Credit Definition Taxedu Tax Foundation

Childctc The Child Tax Credit The White House

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities